The Man Who Lost Over a Billion Dollars | Best Documentary

Moconomy・33 minutes read

Nick Leeson, a former investment banker at Bearings Securities, engaged in fraudulent trading activities that led to losses of over $35 million and the collapse of Barings Bank. Despite initial success, Leeson's deceptive practices and risky behavior ultimately resulted in a global scandal and his arrest.

Insights

- Nick Leeson's fraudulent activities at Barings Bank began with a $60,000 loss in July 1992, escalating to conceal over $35 million in losses by January 1993, showcasing the rapid progression of his deception and the immense pressure to maintain the facade of success.

- The collapse of Barings Bank due to Leeson's fraudulent trading highlighted the financial industry's susceptibility to risky behavior driven by high-pressure environments and incentive structures, emphasizing the allure of rogue traders and the critical need for effective oversight and risk management practices.

Get key ideas from YouTube videos. It’s free

Recent questions

Who is Nick Leon?

A former investment banker turned rogue trader.

Related videos

ColdFusion

How a 28 Year Old Man Destroyed England’s Oldest Bank

Bloomberg Originals

The Wild $50M Ride of the Flash Crash Trader

ColdFusion

When Risk Taking Goes Too Far - The Archegos Collapse

ColdFusion

Enron - The Biggest Fraud in History

FRONTLINE PBS | Official

Breaking the Bank (full documentary) | FRONTLINE

Summary

00:00

"Rogue Trader: Deception and $35 Million Loss"

- Nick Leon, a former investment banker, swapped his working-class roots for the highbrow world of investment banking in London.

- Leon's success in trading caught the attention of John Gapper, who praised his skills and charisma.

- Leon worked for Bearings Securities, a branch known for aggressive trading and a sink-or-swim mentality.

- Bearings Securities, a part of Britain's oldest bank, was seen as wild and different from the traditional bankers at Bearings Brothers.

- Leon was allowed to hold two crucial positions at Bearings Securities, giving him unprecedented freedom and control over the bank's accounts.

- Despite warnings from senior staff about potential disasters, Leon exploited the lack of controls at Bearings Securities.

- Leon's team in Singapore made critical mistakes due to lack of resources and proper procedures, leading to a $60,000 loss in July 1992.

- Instead of reporting the loss, Leon hid it in a secret account, breaking company rules and becoming a rogue trader.

- Leon's deception escalated as he fabricated clients, forged documents, and requested millions in funding from London to cover his losses.

- By January 1993, Leon's deceit had concealed losses of over $35 million, creating immense stress and pressure for him to maintain the facade.

18:38

"Barings Bank Fraud: A Tale of Greed"

- Fraudsters can't go on holiday due to contractual obligations to take two consecutive weeks off, a common practice in banks to prevent fraud.

- Nick Leeson's fraud at Barings Bank began in April 1993 when he bought hundreds of contracts without the bank's knowledge, hoping to make millions.

- Leeson's focus was on surviving day by day, trying to correct losses and gain confidence in unwinding his risky positions.

- Dr. Elizabeth Ner explains dispositional greed as being driven by impulses and a refusal to admit fallibility.

- Leeson's luck changed when his gamble paid off, winning back over $20 million, resulting in a profit instead of a loss.

- Despite a brief celebration, Leeson's fraudulent activities continued, spiraling out of control as he doubled down on risky trades.

- Leeson's fraudulent trading escalated rapidly, with Barings Bank sending over $800 million to him in the first two months of 1995 alone.

- Barings Bank's auditors discovered the fraud in February 1995, leading to increased scrutiny and suspicions about Leeson's trading activities.

- Senior management at Barings Bank were blinded by the allure of Leeson's profits, failing to question the source of his success.

- The beginning of the end for Barings Bank came when auditors uncovered the extent of Leeson's losses, leading to the bank's collapse.

37:00

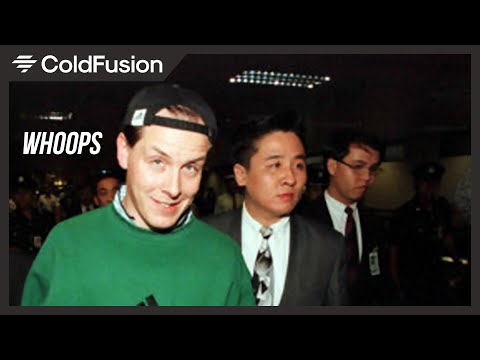

"Global scandal: Bearings collapse and Leeson's arrest"

- Bearings faced insurmountable losses, leading to a global scandal and the disappearance of Nick Leeson, triggering a manhunt.

- Journalist Conrad Raj pursued the story, uncovering Leeson's location at the Regent Hotel in Fumo, where he seemed conflicted and apologetic.

- The collapse of Bearings, a renowned financial institution, shocked the world, with Leeson ultimately being arrested at Frankfurt International Airport.

- The financial industry's high-pressure environment and incentive structures can lead to risky behavior, exemplified by Leeson's crude fraud and the allure of rogue traders in the industry.