Enron - The Biggest Fraud in History

ColdFusion・16 minutes read

Enron, once a major player in the energy market, was revealed to be a massive scam filled with lies and fraud, leading to significant financial losses, job cuts, and legal consequences. Key figures like Kenneth Lay and Jeffrey Skilling were involved in manipulating the company's finances and culture, resulting in a public display of corporate greed and corruption.

Insights

- Enron, once a prominent corporation, was revealed to be a fraudulent scheme involving lies, fraud, and political manipulation, leading to massive financial losses, job cuts, and legal consequences.

- The unraveling of Enron began with investigative journalism by Bethany McLean, exposing corruption and fraud within the company, ultimately resulting in the downfall of Enron and the criminal convictions of top executives like Kenneth Lay and Jeffrey Skilling.

Get key ideas from YouTube videos. It’s free

Recent questions

What was Enron's impact on the energy market?

Enron revolutionized trading and the energy market.

Who were the key figures in the Enron scandal?

Kenneth Lay and Jeffrey Skilling were key figures.

What led to the unraveling of Enron?

Reporter Bethany McLean's questions led to revelations of corruption.

What were some of Enron's fraudulent practices?

Enron engaged in mark-to-market accounting and manipulated markets.

What were the consequences of Enron's collapse?

Enron's collapse resulted in massive losses for investors and job losses.

Related videos

Moconomy

The Man Who Lost Over a Billion Dollars | Best Documentary

Dr. Indrawan Nugroho

Toshiba di Ujung Tanduk karena Taktik Tipu-Tipu

ColdFusion

How a 28 Year Old Man Destroyed England’s Oldest Bank

FRONTLINE PBS | Official

The Untouchables (full documentary) | FRONTLINE

FRONTLINE PBS | Official

Breaking the Bank (full documentary) | FRONTLINE

Summary

00:00

Enron: Rise, Scam, and Collapse

- Enron was once the seventh largest corporation in America, revolutionizing trading and the energy market.

- Despite appearing intricate and smart, Enron was actually a massive scam filled with lies, fraud, and political manipulation.

- The fallout from the Enron scam was monumental, involving billions of dollars stolen, lost jobs, convictions, and a public display of corporate greed.

- Kenneth Lay, Enron's founder, was a key figure in the company's rise, with close political connections, including with George W. Bush.

- Enron's first red flag came in the Valhalla scandal of 1987, where two traders engaged in reckless gambling and theft, encouraged by Lay.

- Jeffrey Skilling, Enron's new CEO, introduced the company to mark-to-market accounting, allowing fraudulent profits to be recorded.

- Skilling implemented a ruthless work culture, grading employees on a scale of one to five and firing those rated poorly.

- Enron's risky ventures included trading bandwidth, weather futures, and even manipulating the California electricity market for profit.

- The unraveling of Enron began with reporter Bethany McLean's questions, leading to revelations of corruption and fraud within the company.

- Enron's collapse resulted in massive losses for investors, job losses for thousands, criminal investigations, and convictions for top executives like Lay and Skilling.

16:42

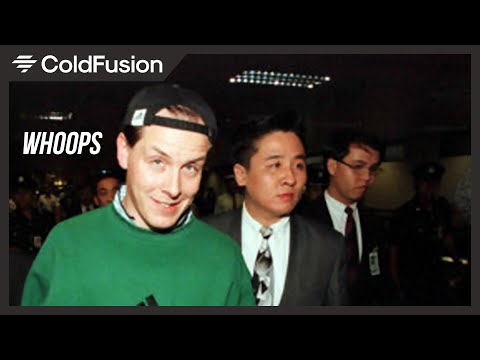

Skilling seeks redemption in energy sector venture.

- Skilling, recently released from prison, is looking to re-enter the energy sector with the help of Lau PI, a former Enron executive, aiming to start a new venture despite his tarnished reputation and SEC restrictions, focusing on private ventures to avoid limitations, marking a unique turn in the Enron saga.