The Math Equation That Beat Wall Street | Jim Simons vs. EMH

Chaos Theory Institute・14 minutes read

Angela trades using the RSI indicator and Bollinger bands to control her financial destiny, believing in mean reversion for price prediction. The Efficient Market Hypothesis discounts technical analysis, while Jim Simons used mathematical models to achieve significant market outperformance with the Medallion fund.

Insights

- The RSI indicator, when below 30, signals oversold conditions and a potential price reversal, guiding Angela's trading decisions.

- Jim Simons, a mathematician who transitioned to finance, founded Renaissance Technologies, utilizing mathematical models to exploit market anomalies and achieve exceptional returns with the Medallion fund, showcasing the power of quantitative strategies in investing.

Get key ideas from YouTube videos. It’s free

Recent questions

What is the RSI indicator?

A technical indicator measuring overbought or oversold conditions.

What are Bollinger bands?

Bands used to identify support and resistance levels.

What is mean reversion in trading?

The belief that prices will return to their trend line.

What is the Efficient Market Hypothesis (EMH)?

The theory that all available information is reflected in stock prices.

Who is Jim Simons?

A mathematician who founded Renaissance Technologies.

Related videos

Newsthink

How a Mathematician Became the Greatest Trader of All Time

Veritasium

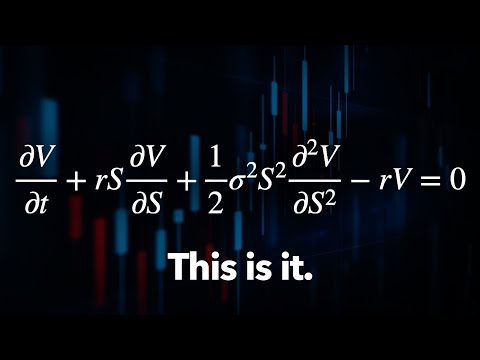

The Trillion Dollar Equation

Chrispy Trades

How to become a profitable futures Day Trader! Trendlines, Supply and Demand and more!

Abhishek Kar

WD Gann Astrology Theory Trading Technique in Hindi

CA Rachana Phadke Ranade

Top 5 Strategies on When to Buy Sell Stocks | CA Rachana Ranade

Summary

00:00

"Angela's Financial Strategy: RSI and Bollinger Bands"

- Angela attempts to control her financial destiny by making a trade using the RSI indicator and Bollinger bands.

- The RSI indicator suggests a potential price reversal as it moves under 30, indicating oversold conditions.

- Angela pairs the RSI indicator with Bollinger bands to identify support and resistance levels.

- Angela believes in mean reversion, predicting prices will return to their trend line after deviation.

- The Efficient Market Hypothesis (EMH) suggests all available information is reflected in stock prices.

- EMH discounts technical and fundamental analysis as having predictive power in markets.

- Morning Star's study shows active managers tend to underperform the market 70-90% of the time.

- Jim Simons, a mathematician, transitioned from academia to finance, founding Renaissance Technologies.

- Simons used mathematical models to identify and exploit anomalies in the market.

- The Medallion fund, under Renaissance, achieved a 66% annualized return for 39 years, outperforming the market significantly.

13:41

"Ticker Symbol News Course for Trading Skills"

- Course covers news articles related to a specific ticker symbol

- Suitable for those interested in equities, options, currency, crypto trading, data science, machine learning, AI, and automation

- Skills learned can be applied beyond investing, such as weather analysis and sports predictions