How a Mathematician Became the Greatest Trader of All Time

Newsthink・13 minutes read

Jim Simons, founder of Renaissance Technologies, achieved extraordinary success with the Medallion hedge fund, which generated an average annual return of 66% over 30 years by using mathematical models and algorithms, primarily employing scientists instead of traditional investors. Despite personal tragedies and challenges, Simons maintained a low public profile while his firm garnered attention for its performance and controversies surrounding the political activities of his colleagues.

Insights

- Jim Simons revolutionized hedge fund management by employing mathematicians and scientists to develop sophisticated trading algorithms, leading to an extraordinary average annual return of 66% over 30 years with the Medallion fund, which transformed a $100 investment in 1988 into nearly $400 million by 2018.

- Despite facing initial struggles, the Medallion fund's success was significantly boosted by a strategic shift to short-term trading, as highlighted by Elwyn Berlekamp, who emphasized that even a slight edge in accuracy could yield substantial profits, demonstrating the importance of adaptability and innovation in financial strategies.

Get key ideas from YouTube videos. It’s free

Recent questions

What is a hedge fund?

A hedge fund is an investment vehicle that pools capital from accredited investors to invest in a variety of assets, often employing complex strategies to generate high returns. Unlike mutual funds, hedge funds are less regulated and can take on more risk, including short selling and leverage. They typically charge both a management fee and a performance fee, which incentivizes fund managers to maximize returns. Hedge funds can invest in stocks, bonds, commodities, and derivatives, and they often use sophisticated financial models and algorithms to inform their trading decisions. The goal of a hedge fund is to achieve absolute returns, regardless of market conditions, making them appealing to investors seeking higher yields.

How do algorithms impact trading?

Algorithms significantly impact trading by enabling the analysis of vast amounts of data to inform investment decisions. They can execute trades at high speeds and with precision, allowing traders to capitalize on market inefficiencies and trends that may not be visible to human analysts. Algorithmic trading can reduce transaction costs and improve liquidity in the markets. Additionally, algorithms can incorporate various data sources, including historical price movements, economic indicators, and even social media sentiment, to predict future price movements. This technological advancement has transformed trading strategies, making them more data-driven and systematic, which can lead to more consistent performance in volatile markets.

What is the role of mathematicians in finance?

Mathematicians play a crucial role in finance by applying mathematical theories and models to solve complex problems related to pricing, risk management, and investment strategies. Their expertise in statistics, probability, and computational methods allows them to develop algorithms that can analyze market data and identify patterns that inform trading decisions. In hedge funds and quantitative finance firms, mathematicians work alongside computer scientists and financial analysts to create sophisticated models that predict market behavior and optimize portfolios. This interdisciplinary approach enhances the ability to manage risks and maximize returns, making mathematicians invaluable in the increasingly data-driven financial landscape.

What are the benefits of using data science in trading?

The benefits of using data science in trading include improved decision-making, enhanced predictive accuracy, and the ability to process large datasets efficiently. Data science techniques, such as machine learning and statistical analysis, allow traders to uncover hidden patterns and correlations in market data that traditional methods may overlook. By leveraging diverse data sources, including economic indicators, market sentiment, and historical trends, traders can develop more robust trading strategies. Additionally, data science enables real-time analysis and automated trading, which can lead to quicker responses to market changes and better risk management. Overall, integrating data science into trading practices can significantly enhance performance and profitability.

What is the significance of short-term trading strategies?

Short-term trading strategies are significant because they allow traders to capitalize on small price movements within a brief time frame, often leading to quick profits. These strategies rely on technical analysis and market trends, enabling traders to make rapid decisions based on real-time data. By focusing on short-term trades, investors can take advantage of market volatility and liquidity, which can yield higher returns compared to long-term investments. Additionally, short-term trading can help mitigate risks associated with holding positions over extended periods, as it reduces exposure to market fluctuations. This approach is particularly appealing to traders who prefer active management and seek to maximize their investment returns in a dynamic market environment.

Related videos

San Francisco State University

James H. Simons: Mathematics, Common Sense and Good Luck

TED

The mathematician who cracked Wall Street | Jim Simons

hamsterpoop

James Simons - Mathematics, Common Sense, and Good Luck: My Life and Careers

Chaos Theory Institute

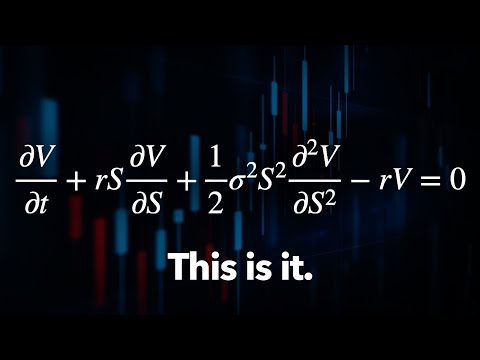

The Math Equation That Beat Wall Street | Jim Simons vs. EMH

Veritasium

The Trillion Dollar Equation

Summary

00:00

Jim Simons Revolutionizes Hedge Fund Success

- Jim Simons, founder of Renaissance Technologies, created the Medallion hedge fund, which has achieved an average annual return of 66% over 30 years, turning a $100 investment in 1988 into $398.7 million by 2018, according to economist Bradford Cornell.

- Simons employed mathematicians and scientists rather than traditional investors, believing that markets operate logically, and he utilized vast data sets, computer models, and algorithms to inform trading decisions.

- After a successful academic career, including a position at Stony Brook University, Simons founded Renaissance Technologies in 1978, initially named Monemetrics, focusing on decoding market patterns through mathematical models.

- The Medallion fund initially struggled to profit, but a pivotal change occurred when Elwyn Berlekamp restructured the trading strategy to focus on short-term trades, emphasizing that being right just 51% of the time could yield profits.

- In 1990, after a decade of refining algorithms, Medallion posted a 58% return after fees, prompting Simons to aim for even higher returns, leading to Berlekamp's departure and Simons consolidating operations under Renaissance Technologies.

- Simons expanded his team by recruiting Robert Mercer and Peter Brown, who developed a sophisticated automated stock trading system in 1995, which significantly improved the fund's performance, culminating in a 98.5% return in 2000.

- The Medallion fund, capped at $10 billion, is exclusively available to Renaissance employees, who can invest personally, and it closed to outside investors in 2003, leading to the nickname “Renaissance Riviera” for the area where many employees bought homes.

- Renaissance Technologies employs non-disclosure agreements to protect its trading algorithms, making it a target for competitors, while advancements in technology allow for the analysis of diverse data sets, including social media sentiment and consumer behavior.

- Following personal tragedies, including the deaths of his sons, Simons launched the Renaissance Institutional Equities Fund (RIEF) for outside investors, which successfully navigated the 2007 subprime mortgage crisis and achieved 82% profits in 2008.

- Simons stepped down as CEO in 2009, passing leadership to Mercer and Brown, while maintaining a low public profile, contrasting with Mercer’s political involvement as a major supporter of Donald Trump, despite Simons’ support for Hillary Clinton.

13:30

Mercer Controversy Sparks Financial Withdrawals

- David Magerman expressed concerns about Robert Mercer’s involvement in politics, leading to the Baltimore City Fire and Police Employees’ Retirement System withdrawing $32 million from Renaissance Technologies, prompting fears of a mass exodus. In November 2017, Mercer resigned as co-CEO and sold his stake in Breitbart News, while Jim Simons, with a net worth of $27 billion, has made significant contributions including $500 million to Stony Brook University and established a nonprofit to support math teachers and autism research.

- To enhance math skills, the text recommends using Brilliant, a website and app for interactive learning in math, data science, and computer science. Users can start at their own level and access explanations for difficult problems. A free 30-day trial is available through the link brilliant.org/newsthink, and the first 200 sign-ups will receive a 20% discount on a Premium subscription, unlocking all courses.