Consumer's Surplus | Hicksian Approach To Consumers Surplus | Hicks Consumers Surplus | Economics

Yasser Khan..・7 minutes read

The text explains the evolution of consumer surplus, outlining its key concepts and how to calculate it, using examples including ticket purchasing and goods from OLX to illustrate these principles. It emphasizes the intersection of budget lines and indifference curves while introducing upcoming discussions on more complex economic concepts related to marginal utility.

Insights

- The evolution of consumer surplus, as explained by the speaker, emphasizes its development from earlier theories to Alfred Marshall's interpretation, which integrates cardinal utility and the use of indifference curves to better understand consumer behavior, highlighting how these concepts help determine the price a consumer is willing to pay compared to the market price.

- The speaker outlines four key concepts of consumer surplus—Price Compensating Variation, Price Equal Variation, Quantity Compensating Variation, and Quantity Equal Variation—using a practical example of a ticket purchase to clarify these ideas, while also providing a formula to calculate consumer surplus that underscores the financial benefit consumers gain when they pay less than what they are willing to pay.

Get key ideas from YouTube videos. It’s free

Recent questions

What is consumer surplus?

Consumer surplus is an economic concept that measures the difference between what consumers are willing to pay for a good or service and what they actually pay. It reflects the additional benefit or utility that consumers receive when they purchase a product for less than the maximum price they are prepared to pay. This concept has evolved over time, with significant contributions from economists like Alfred Marshall, who refined earlier theories by incorporating ideas such as cardinal utility and indifference curves. Understanding consumer surplus is crucial for analyzing consumer behavior and market efficiency, as it provides insights into how much value consumers derive from their purchases.

How is consumer surplus calculated?

Consumer surplus is calculated using the formula: Consumer Surplus = Price Willing to Pay - Price Actually Paid. This calculation involves determining the maximum price a consumer is willing to pay for a good or service and subtracting the actual market price they pay. For example, if a consumer is willing to pay 100 rupees for a concert ticket but only pays 70 rupees, the consumer surplus would be 30 rupees. This surplus indicates the extra benefit the consumer receives from the transaction, highlighting the value they place on the good relative to its market price. Understanding this calculation helps in assessing consumer welfare and market dynamics.

What are indifference curves?

Indifference curves are graphical representations used in microeconomics to illustrate consumer preferences and the trade-offs between different goods. Each curve represents a combination of two goods that provide the same level of satisfaction or utility to the consumer. The shape and position of these curves help economists understand how consumers make choices based on their preferences and budget constraints. When analyzing consumer surplus, indifference curves are essential as they intersect with budget lines, indicating the optimal consumption point where consumers maximize their utility given their income. This concept is fundamental in understanding consumer behavior and market equilibrium.

What is the significance of budget lines?

Budget lines are graphical representations that show the combinations of two goods that a consumer can purchase given their income and the prices of those goods. The budget line illustrates the trade-offs consumers face when allocating their limited resources among different products. It is significant because it helps to determine the consumer's optimal choice, where the budget line intersects with an indifference curve, indicating the highest level of utility achievable within their budget. Understanding budget lines is crucial for analyzing consumer surplus, as they provide a framework for evaluating how changes in prices or income affect consumer decisions and overall market dynamics.

What is marginal utility of money?

The marginal utility of money refers to the additional satisfaction or utility that a consumer derives from spending an additional unit of currency. It is a key concept in economics that helps explain consumer behavior and decision-making. The idea is that as a consumer spends more money, the utility gained from each additional unit of currency tends to decrease, a phenomenon known as diminishing marginal utility. This concept is important for understanding consumer surplus, as it influences how consumers value goods and services relative to their prices. Recognizing the constant nature of marginal utility of money allows economists to predict consumer choices and market trends more accurately.

Related videos

Magnet Brains

Class 11 Microeconomics Ch 2 | Consumer's Equilibrium (Sandeep Garg)- One Shot Full Chapter Revision

MIT OpenCourseWare

2. Preferences and Utility Functions

Commerce Wallah by PW

Consumer's Equilibrium - Utility Analysis in 1 Shot - Everything Covered | Class 11th Economics🔥

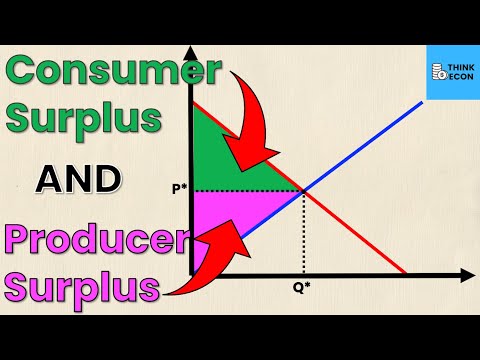

Think Econ

How to Calculate Producer Surplus and Consumer Surplus from Supply and Demand Equations | Think Econ

CA Hardik Manchanda

Theory of Demand - CA Foundation Economics Marathon | CA Foundation Dec 2023 | CA Hardik Manchanda

Summary

00:00

Understanding Consumer Surplus and Its Concepts

- The concept of consumer surplus is introduced, highlighting its evolution from earlier theories to Marshall's interpretation, which addresses previous flaws and incorporates the idea of cardinal utility, emphasizing the importance of indifference curves in understanding consumer behavior.

- The discussion includes four key concepts of consumer surplus: Price Compensating Variation, Price Equal Variation, Quantity Compensating Variation, and Quantity Equal Variation, with a practical example involving a ticket purchase for 45 rupees to illustrate these concepts.

- A budget line (AB) is established to analyze consumer surplus, where the speaker explains how to determine the price a consumer is willing to pay versus the actual market price, emphasizing the importance of understanding the intersection of the indifference curve and the budget line.

- The speaker notes that consumer surplus is calculated as the difference between the price a consumer is willing to pay and the actual price paid, using the formula: Consumer Surplus = Price Willing to Pay - Price Actually Paid, and illustrates this with a relatable example involving purchasing goods from OLX.

- The video concludes with a reminder that the marginal utility of money is constant, and hints at more complex concepts related to diminishing marginal utility that will be covered in future discussions, encouraging viewers to engage with the content by liking, sharing, and subscribing.