NPV vs IRR

Edspira・7 minutes read

MPV is used to evaluate firm projects by measuring added wealth, while IRR calculates a rate to make MPV zero. Decision rules dictate accepting projects with MPV > 0 and IRR rate < or > discount rate, prioritizing MPV over IRR in mutually exclusive projects due to scale effects.

Insights

- MPV and IRR are methods used to evaluate projects in a firm, with MPV indicating added wealth and IRR aiming to equate MPV to zero by determining a rate.

- In scenarios with mutually exclusive projects, MPV is favored over IRR due to its consideration of scale effects, resulting in more substantial wealth added to the firm. Understanding the appropriate application of MPV and IRR is vital, particularly in cases with intricate cash flow patterns that could complicate IRR calculations.

Get key ideas from YouTube videos. It’s free

Recent questions

What are MPV and IRR used for?

Evaluate projects at a firm.

Related videos

Summary

00:00

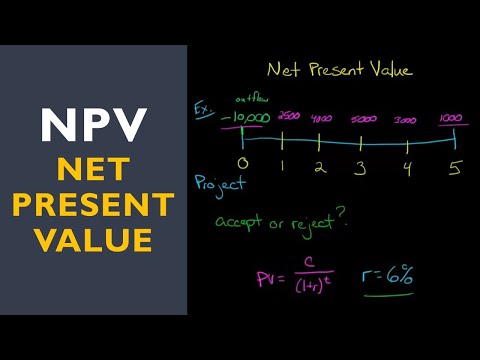

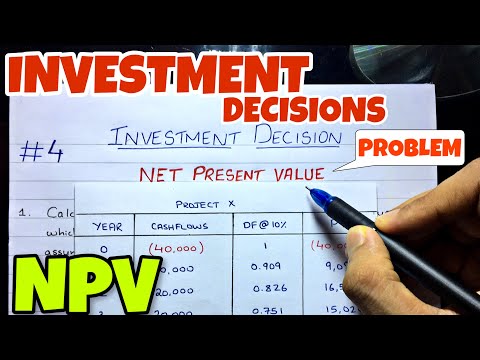

Evaluating Projects: MPV vs IRR

- MPV and IRR are methods to evaluate projects at a firm, with MPV representing added wealth and IRR aiming to make MPV zero by calculating a rate.

- Decision rules: Accept projects with MPV greater than zero and IRR rate smaller or larger than the discount rate.

- IRR can present issues, especially in cases where there are multiple solutions or no solution due to alternating negative and positive cash flows.

- In situations with mutually exclusive projects, where only one can be chosen, MPV is preferred over IRR as it considers the effects of scale, leading to a more significant wealth addition to the firm.

- Understanding when to use MPV over IRR is crucial, especially in scenarios with specific cash flow patterns that may cause problems with IRR calculations.