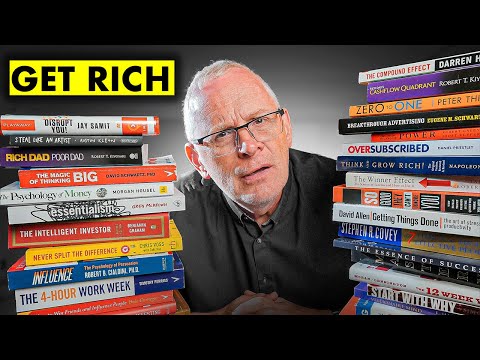

I read 40 books on money. Here's what will make you rich

Nischa・14 minutes read

The author explores key books on money and investing like Rich Dad Poor Dad, The Four Hour Work Week, and The Psychology of Money, emphasizing concepts such as assets, passive income, and leveraging time effectively to achieve financial freedom and success in investing. The importance of mindset, disciplined decision-making, and investing in oneself through improving skills or starting a side hustle is highlighted for both short-term gains and long-term financial success.

Insights

- Rich Dad Poor Dad emphasizes the distinction between assets that generate income and liabilities that drain money, underlining the significance of building wealth through income-generating assets while avoiding financially draining liabilities.

- Success in investing necessitates discipline, persistence, and emotional control, with a focus on investing in oneself through skill improvement or side hustles for short-term gains, highlighting the importance of personal development before delving into the stock market for immediate success.

Get key ideas from YouTube videos. It’s free

Recent questions

What are some key concepts in financial literature?

Financial literature covers assets, liabilities, income generation, mindset, and passive income.

How can one achieve financial freedom?

Financial freedom can be attained by leveraging time, smart work, and passive income sources.

What is the significance of mindset in financial success?

Mindset plays a crucial role in financial success, influencing beliefs and actions.

What are recommended books for beginner investors?

Beginner investors can benefit from books like The Intelligent Investor and Girls That Invest.

What is the emphasis on investing in oneself?

Investing in oneself through skill improvement and side hustles is vital for short-term success.

Related videos

Tae Kim - Financial Tortoise

18 Wealth Lessons From The Psychology of Money

Mark Tilbury

After I Read 40 Books on Money - Here's What Will Make You Rich

The Diary Of A CEO

The Savings Expert: “Do Not Buy A House!” Do THIS Instead! - Morgan Housel

Daniel Ramsey

Founder CEO shares all the books that helped build a $100M enterprise | Daniel Ramsey

دروس أونلاين

بودكاست مع أسامة الزيرو I حياته بعيداً عن البرمجة، الهوايات والجيمنج والرياضة والقراءة وتنظيم وقته.

Summary

00:00

"Mastering Money: Books for Financial Success"

- The author has extensively read books on money and investing, ranging from classics like Rich Dad Poor Dad to more psychology-focused ones like Think and Grow Rich.

- Rich Dad Poor Dad introduces the concept of assets and liabilities, emphasizing the importance of assets that generate income and avoiding liabilities that drain money.

- The Cash Flow Quadrant discusses four ways to earn money: as an employee, self-employed, a business owner, or an investor, highlighting the path to financial freedom.

- The Four Hour Work Week by Tim Ferriss focuses on working smarter, building a business, automating it, and living a millionaire lifestyle by leveraging time effectively.

- The Millionaire Fast Lane distinguishes between the sidewalk, slow lane, and fast lane approaches to financial life, emphasizing leveraging time to create passive income for wealth accumulation.

- Think and Grow Rich explores the impact of mindset on financial success, emphasizing the importance of abundance-oriented beliefs and consistent action.

- The Psychology of Money delves into the psychological aspects of money management, highlighting the role of mindset and past experiences in shaping financial decisions.

- Ignorance debt concept suggests that beginner investors may overestimate their knowledge, recommending books like The Intelligent Investor and Girls That Invest to build a strong foundation.

- The Intelligent Investor and Girls That Invest provide essential knowledge for beginner investors, focusing on rational decision-making, market behavior, and understanding investing terminology.

- The Little Book of Common Sense Investing and follow-up books like The Dhandho Investor and One Up on Wall Street advocate for index funds and investing in familiar, everyday products for long-term financial success.

12:02

Invest in Yourself for Investing Success

- Success in investing requires discipline, persistence, and emotional control, with the importance of investing in oneself before the stock market being highlighted for short-term gains. Investing in oneself, such as improving money management skills or starting a side hustle, is emphasized as crucial for short-term success, although it demands more effort, discipline, and knowledge.