How to Invest for Beginners (2024)

Ali Abdaal・28 minutes read

Investing offers various options like stocks, real estate, and crypto to grow money over time and combat inflation, with beginners advised to start with accessible investments like stocks and index funds on platforms like Trading 212. Fast Lane investing in oneself or personal business can provide higher returns than traditional stock market investments through education and skill development.

Insights

- Investing offers a wide range of options, from stocks and shares to real estate and crypto, each with unique characteristics and risks.

- Beginners in investing commonly face the fear of losing money, emphasizing the importance of understanding basics, addressing concerns, and considering accessible options like index funds.

Get key ideas from YouTube videos. It’s free

Recent questions

What are the common options for investing?

Stocks, shares, real estate, crypto, NFTs, etc.

How can beginners overcome the fear of losing money in investing?

By understanding investing basics and philosophy.

What is the purpose of investing?

To make money grow over time.

How can beginners start investing in stocks?

By investing in accessible options like index funds.

What are some alternative investment categories to consider?

Real estate, crypto, and fast lane investing.

Related videos

Easy Peasy Finance

What is Investing? A Simple Explanation for Kids and Beginners

Big Think

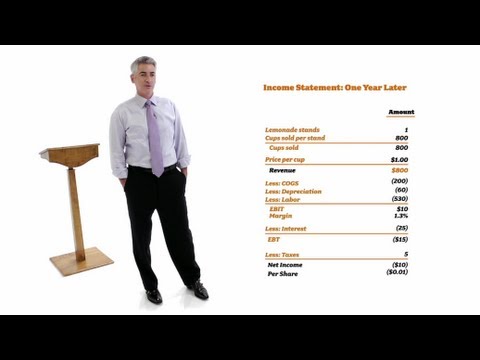

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour | Big Think

Shobha Rana

Rich People Don't Want You To Know This! Ft. @AbhishekKar | TJW-57

warikoo

Where to INVEST in 2024? | Investing Tips for 2024! | Ankur Warikoo Hindi

Orkun Işıtmak

5.000TL'yi 40.000TL YAPMAK! BİTCOİN İLE ZENGİN OLMAK! @CoinMuhendisi

Summary

00:00

Beginner's Guide to Diverse Investment Options

- Investing involves various options like stocks, shares, equities, government bonds, real estate, foreign exchange, crypto, NFTs, futures, fine art, and watches.

- The fear of losing hard-earned money is common among beginners in investing.

- The Ultimate Guide to Investing For Beginners is divided into four parts: basics and philosophy, investing in stocks and shares, addressing fears and concerns, and fast lane investing.

- The purpose of investing is to make money grow over time to combat inflation.

- Investing involves buying assets that can generate income or appreciate in value.

- Rental income from assets like houses contrasts with the hope of selling other assets at a higher price.

- Stocks and shares are accessible investments for beginners, unlike real estate or high-risk options like crypto.

- Investing in stocks means owning a percentage of a company, potentially earning from price appreciation or dividends.

- Warren Buffett advises beginners to invest in index funds like the S&P 500 to diversify and track market performance.

- Online platforms like Charles Stanley Direct, Vanguard, and Trading 212 facilitate investing in index funds and individual stocks.

10:26

"Trading 212: Investing Tips and Strategies"

- Trading 212 allows stock and share trading and offers an Isa for UK residents.

- Practice investing with fake money is possible on Trading 212 to gain familiarity with investing concepts.

- Deposits up to £2000 can be made through Apple Pay on Trading 212, followed by bank transfers.

- The "pies" feature on Trading 212 allows users to view and copy investment portfolios created by others.

- It is recommended to invest in broad stock market index funds like the S&P 500.

- Starting investing with platforms like Trading 212 or Vanguard can require as little as £5 or £100 respectively.

- Investing in real estate and crypto are other categories to consider for investment.

- Fast Lane investing involves investing in oneself or one's own business for higher returns than traditional stock market investments.

- Investing in education or skills can significantly increase earning potential, surpassing stock market returns.

- Building and growing a personal business can yield higher returns than investing in external companies like Apple or Tesla.