Habits, mistakes & mindset to know about money w/ Lámidé Elizabeth

The Balance Theory Podcast・51 minutes read

The guest, a recent London School of Economics graduate and successful banker, shares insights on finance, wealth management, and overcoming lifestyle inflation to build wealth. She emphasizes the importance of early money management habits and aligning spending with personal values to achieve financial goals.

Insights

- Early money management is crucial, akin to building a muscle over time, as highlighted by her journey from a challenging background to excelling professionally through banking.

- Lifestyle inflation poses a significant barrier to wealth accumulation, underscoring the importance of setting clear financial goals, aligning spending with personal values, and saving with specific intentions to combat aimless spending and prioritize long-term financial objectives.

Get key ideas from YouTube videos. It’s free

Recent questions

How can I combat lifestyle inflation?

Combat lifestyle inflation by setting clear financial goals.

Why is saving money important?

Saving money is crucial for building wealth and financial freedom.

How can I make money work for me?

Make money work for you by investing in assets that generate returns.

How can I shift from a scarcity to an abundant mindset?

Shift from scarcity to an abundant mindset by understanding limiting beliefs.

Why is it important to set personal financial goals?

Setting personal financial goals ensures alignment with individual desires.

Related videos

Vietcetera

Làm nội dung về tiền thì có giỏi về tiền? - BTV Ngọc Trinh | #TheMoneyDate SS2 Ep14

Irmãos Dias Podcast

DEIXE DE SER POBRE! (EDUARDO PRIMO POBRE) | Irmãos Dias Podcast 124

Lutz Podcast

Eduardo Feldberg (Primo Pobre): Como Deixar de Ser Pobre | Lutz Podcast #218

The Diary Of A CEO

The Money Expert: "Do Not Buy A House!" 10 Ways To Make REAL Money: Ramit Sethi

Ali Abdaal

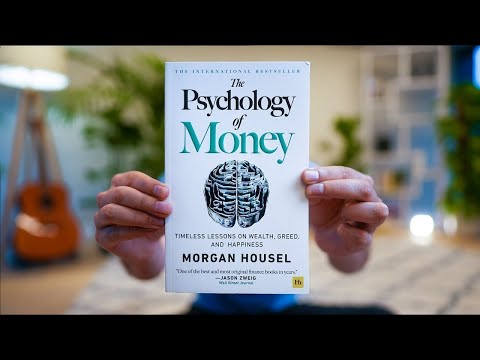

The Book That Changed My Financial Life 🤑

Summary

00:00

Banking graduate shares wealth-building insights

- The guest is a recent graduate of the London School of Economics, recognized for her achievements as one of the UK's top 10 black students and UK Corporate Finance Women of the Year.

- She currently works at the world's largest Investment Bank and started a YouTube channel to assist others in launching careers at top firms, transitioning to finance, wealth, side hustling, investing, entrepreneurship, and lifestyle content.

- Growing up in a challenging neighborhood and attending a state school, she defied odds to excel academically and professionally.

- Her interest in understanding wealth and poverty led her to study economic history, focusing on the wealth and poverty of nations.

- Banking was her pathway out of her circumstances due to its high pay in London.

- At 18, she began educating herself about money, saving heavily, and reading "Rich Dad Poor Dad," emphasizing the importance of starting early in developing good money habits.

- She highlights the significance of early money management, likening it to a muscle that strengthens over time.

- She discusses the impact of past traumas on financial decisions, such as trying to prove oneself to a younger version or compensating for childhood scarcity.

- Lifestyle inflation, where spending increases with income without a corresponding rise in savings, is identified as a barrier to wealth accumulation.

- Despite high earnings, she observed senior colleagues in banking still facing financial challenges due to lifestyle inflation, underscoring the importance of managing money wisely.

12:15

"Combat Lifestyle Inflation: Save with Purpose"

- People in the UK earn an average of 30k a year, but some earn 200k to 250k a year, not including bonuses.

- Lifestyle inflation occurs when people increase their spending as they earn more money.

- Lifestyle inflation involves upgrading one's lifestyle as income increases.

- To combat lifestyle inflation, have a clear direction for your money and set goals for the future.

- Value-based spending involves questioning the intention behind purchases and aligning them with personal values.

- Saving money is crucial for building wealth and allowing money to work for you.

- The 50-30-20 rule suggests allocating 50% to needs, 30% to wants, and 20% to savings.

- Saving pots with specific intentions, like an "I Quit Fund," can motivate saving and align with personal goals.

- It's essential to save with clear intentions to avoid aimless spending and prioritize financial goals.

- Focus on one savings goal or multiple based on personal priorities and alignment with long-term desires.

23:30

"Aligning Personal Goals for Financial Freedom"

- Home ownership is a significant goal in countries like the UK and Australia, but not universally valued worldwide.

- People often adopt others' goals, like buying a house, without considering if it aligns with their own aspirations.

- In the UK, choosing between buying an investment property or a residential property is crucial, limiting flexibility.

- Setting personal goals is essential, ensuring they align with individual desires and not societal pressures.

- Different life stages, like post-COVID travel, weddings, and property purchases, can create financial pressures.

- Balancing financial decisions is crucial to avoid unnecessary stress and align spending with personal desires.

- Hoarding money out of fear can hinder financial growth, while saving with a purpose can lead to financial freedom.

- Making money work for you involves investing in assets that generate returns, like businesses or properties.

- Distinguishing between assets and liabilities is key to understanding how to make money work for you.

- Investing in properties, businesses, or stocks should align with personal enjoyment and expertise to avoid overwhelm and procrastination.

35:18

Overcoming scarcity mindset through financial awareness

- Shift from scarcity to an abundant mindset by understanding where the scarcity mindset originates and how it impacts behavior.

- Recognize habits influenced by scarcity mindset, such as excessive independence due to past financial limitations.

- Engage with individuals possessing an abundant mindset through reading and mentorship to grasp their perspectives on money as a game.

- Learn to view money as a tool and game rather than a source of fear, observing how successful individuals approach leverage and debt.

- Identify personal money dials, areas where spending is easy or difficult, to comprehend individual financial comfort zones.

- Embrace awareness of limiting beliefs, seek guidance from others, and gradually develop new beliefs to overcome scarcity mindset, focusing on a few effective strategies before progressing further.