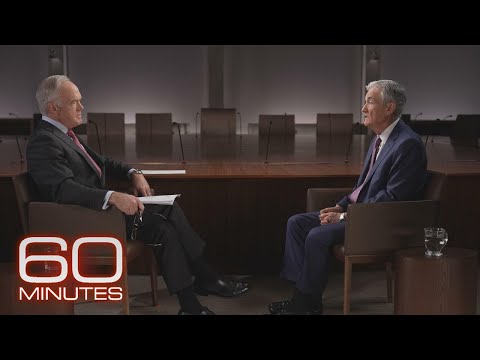

Fed Chair Jerome Powell: The 2024 60 Minutes Interview

60 Minutes・11 minutes read

Jerome Powell raised interest rates to combat high inflation, aiming to restore price stability for public benefit, cautiously waiting for evidence before making significant cuts. Powell emphasizes managing inflation to ensure economic balance and avoid negative impacts like recession, attributing recent economic growth to pandemic-related factors.

Insights

- Jerome Powell raised interest rates to control inflation, maintaining economic stability and employment levels, with a focus on gradually reducing rates pending sustainable inflation decline.

- Powell underscores the significance of price stability and inflation management to sustain economic equilibrium, attributing recent growth to specific pandemic-related factors like semiconductor shortages impacting industries.

Get key ideas from YouTube videos. It’s free

Recent questions

What is the role of Jerome Powell?

Chair of the Federal Reserve

What is the current inflation rate?

Significantly decreased over the past year

What is the target inflation rate?

2%

What is the recent decision on interest rates?

Rates would remain unchanged at 5.5% for six months

What factors influence economic growth according to Powell?

Unique pandemic-related dynamics like semiconductor shortages

Related videos

The Wall Street Journal

How the Fed Steers Interest Rates to Guide the Entire Economy | WSJ

Firstpost

The Fed May Induce a Recession in the US: Why is it a Concern for India? | Vantage with Palki Sharma

60 Minutes

Chairman Powell; A Hole in the System; The Mismatch | 60 Minutes Full Episodes

CNBC

How The U.S. Tries To Control Inflation

The Economist

How does raising interest rates control inflation?

Summary

00:00

Federal Reserve Chair Maintains Interest Rates

- Jerome Powell, Chair of the Federal Reserve, raised interest rates 11 times to combat high inflation, avoiding a recession while maintaining strong employment levels.

- Inflation has significantly decreased over the past year, with a focus on restoring price stability to benefit the public.

- The Federal Reserve aims to reduce interest rates cautiously, waiting for more evidence of sustainable inflation decline before making significant cuts.

- The target inflation rate is 2%, allowing for future interest rate adjustments to combat economic downturns effectively.

- The Federal Reserve boardroom, where interest rates are set, recently announced rates would remain unchanged at 5.5% for six months.

- The majority of the committee members anticipate a federal funds rate cut in the upcoming year, likely in small increments based on inflation data.

- Powell attributes the recent economic growth and job additions to unique pandemic-related dynamics, such as semiconductor shortages affecting car production.

- Powell emphasizes the importance of restoring price stability and managing inflation to ensure economic balance and avoid potential negative impacts like recession.