Dear Rudy: I borrowed $20,000 on a Credit Card to invest in Magic

Alpha Investments・18 minutes read

Leveraging can be a powerful yet risky tool in investing, emphasizing the importance of responsible use and timing in selling investments to avoid losses and maximize profits, particularly when using credit cards strategically. Establishing a disciplined approach to leveraging, building wealth gradually, and understanding the potential risks and benefits are essential for long-term financial growth.

Insights

- Proper timing of selling investments is crucial to avoid losses when interest rates come into play, emphasizing the necessity of strategic decision-making in financial endeavors.

- Establishing a disciplined approach to leveraging, selling, and debt management is key to long-term asset accumulation and wealth building, underscoring the importance of a prudent and patient mindset in financial planning.

Get key ideas from YouTube videos. It’s free

Recent questions

What is the significance of leveraging in investing?

Leveraging in investing can be a risky yet powerful tool that allows individuals to amplify their returns by using borrowed funds. It is crucial to use leverage wisely, as it can magnify both gains and losses. By borrowing money to invest, individuals can potentially increase their profits, but they also expose themselves to higher risks. Understanding how to effectively leverage can help investors maximize their returns while managing the associated risks.

Why is selling investments important in realizing profits?

Selling investments is essential in realizing profits because simply holding onto assets indefinitely does not guarantee making money. By selling investments at the right time, investors can lock in gains and capitalize on market opportunities. Knowing when to sell is crucial, as waiting too long can lead to losses, especially when interest rates or other factors come into play. Selling investments strategically is key to achieving financial success in the investing world.

How can credit cards be used for leverage in investing?

Credit cards can be used for leverage in investing by taking advantage of promotional offers, such as 0% interest rates for a certain period. By leveraging a credit card, investors can access funds to invest without incurring immediate interest charges. However, it is important to be mindful of the interest rates that kick in after the promotional period ends, as they can significantly impact returns. Effectively managing balance transfer fees and utilizing credit cards strategically can be a viable way to leverage in investing.

Why is timing important when selling investments?

Timing is crucial when selling investments because the market conditions can greatly impact the returns that investors realize. Waiting too long to sell can lead to losses, especially when interest rates or other factors change. By understanding the importance of timing, investors can make informed decisions about when to sell their assets to maximize profits and minimize risks. Having a strategic approach to timing in selling investments is key to achieving financial success in the investing world.

What is the role of liquidity in investments?

Liquidity plays a significant role in investments, as it determines the ease of selling assets at desired prices. Assets that are highly liquid can be easily converted into cash without significant price changes, providing investors with flexibility and control over their investments. Understanding the liquidity of investments, such as Magic cards, can help investors make informed decisions about buying and selling assets. Having liquid investments can also help investors react quickly to market changes and capitalize on opportunities for profit.

Related videos

Alex Hormozi

"I'm Broke... What Should I Do?"

warikoo

Where to INVEST in 2024? | Investing Tips for 2024! | Ankur Warikoo Hindi

Big Think

William Ackman: Everything You Need to Know About Finance and Investing in Under an Hour | Big Think

Tom Bilyeu

The 3 MONEY HABITS That Keep You BROKE! (RICH VS POOR MINDSET) | Wallstreet Trapper

Shobha Rana

Rich People Don't Want You To Know This! Ft. @AbhishekKar | TJW-57

Summary

00:00

"Strategic leveraging for long-term wealth growth"

- Leverage can be a risky yet powerful tool in investing, with the responsibility of using it wisely being crucial.

- Selling investments is essential to realize profits, as holding onto them indefinitely does not equate to making money.

- Leveraging $20,000 on a 0% credit card for 12 months can be a strategic move, but the interest rates after the promotional period can significantly impact returns.

- Utilizing credit cards for leverage can be a viable strategy, especially when managing the balance transfer fees effectively.

- The importance of timing in selling investments is highlighted, as waiting too long can lead to losses when interest rates kick in.

- The significance of liquidity in investments, like Magic cards, is emphasized, as it affects the ease of selling assets at desired prices.

- Having an exit strategy is crucial when leveraging, with options like rolling over balances to new 0% credit cards or treating the debt as a monthly bill to pay off gradually.

- Emotional pressure and stress can arise when facing impending interest rate increases, impacting the enjoyment and success of investments.

- Establishing a disciplined approach to leveraging, selling, and paying off debts can lead to long-term asset accumulation and wealth building.

- Building a mindset of long-term investing and wealth creation, rather than quick gains, is essential for sustainable financial growth.

14:01

Magic card market boom and leverage risks.

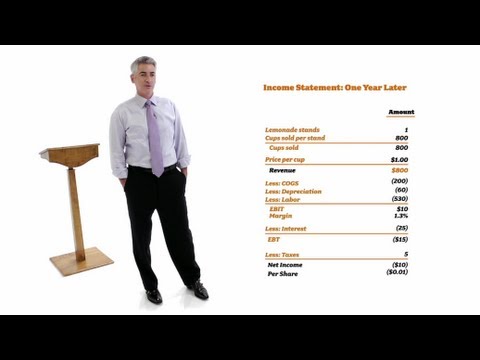

- Before the 2017 market boom, cards like Arabian Nights, Antiquities, and Revised Jewels slowly gained value, unnoticed by many, until the significant spike in 2017 that left most of the magic community without a share of the wealth created.

- The aftermath of the 2017 market spike led to retracements in 2018 and 2019, causing anger among those who missed out on the massive returns, highlighting the importance of understanding leverage and its potential risks and benefits in investments.

- Leverage, when used wisely, can be a powerful tool in building wealth, but it also carries significant risks, as seen in the cautionary tale of a man who lost $20,000 due to leveraging, emphasizing the need to differentiate between good and bad debt.