American Big Tech Has Enslaved Us | Aaron Bastani Meets Yanis Varoufakis

Novara Media・48 minutes read

Amazon generates significant profits in Europe without paying taxes, while the rise of Cloud Capital has allowed tech giants like Bezos to extract massive profits, resembling feudalism. The Eurozone traps countries like Italy and Greece in permanent austerity, leading to economic struggles and mass emigration.

Insights

- The rise of Cloud Capital, exemplified by tech giants like Amazon, allows for massive profits without corresponding tax contributions, resembling a feudalistic system of extraction.

- The shift away from traditional capitalism towards a cloud capital-dominated economy has led to significant financialization, with central banks printing vast sums post-2008 crisis, benefiting elites while burdening the working class and reshaping market dynamics through data analytics and digital platforms.

Get key ideas from YouTube videos. It’s free

Recent questions

How does Cloud Capital impact tech giants' profits?

Cloud Capital enables tech giants like Jeff Bezos to extract massive profits, resembling feudalism. This mutated form of capital allows these companies to amass wealth through digital platforms and data analytics, altering traditional market dynamics and favoring companies like Amazon over traditional manufacturers. The rise of Cloud Capital has transformed industries like car manufacturing, leading to the dominance of companies like Tesla in the market. This shift highlights the power and influence these tech giants wield in the economy, shaping the future of capitalism and economic structures.

What led to the breakdown of the fixed exchange rate regime?

The breakdown of the fixed exchange rate regime was primarily caused by the increasing quantity of dollars in circulation. Between 1944 and 1971, the US maintained a trade surplus post-WWII, ensuring the recycling of dollars globally. However, a trade deficit in the late 1960s raised concerns about the dollar's value and gold redemption. As the US printed more dollars to finance its deficit, the fixed exchange rate system became unsustainable, leading to the eventual collapse of the Bretton Woods system. This breakdown marked the rise of American hegemony and the shift towards a more flexible exchange rate system.

How did the 2008 financial crisis impact central banks?

After the 2008 financial crisis, central banks printed $35 trillion to bail out bankers, resulting in inflated asset prices but minimal investment. This massive injection of liquidity aimed to stabilize the financial system and prevent a complete collapse. However, the aftermath saw inflated asset prices, particularly in the housing market, without a corresponding increase in productive investment. The central bank intervention highlighted the interconnectedness of the financial system and the risks associated with excessive money creation and financialization, shaping the post-crisis economic landscape.

What are the implications of the Eurozone membership for countries like Greece?

Membership in the Eurozone has had significant implications for countries like Greece, leading to internal devaluation and reduced purchasing power for citizens. Upon entering the Eurozone, countries had to relinquish control over their monetary policy, limiting their financial autonomy. This loss of control over currency issuance and interest rates has constrained countries like Greece, resulting in economic struggles, mass emigration, and permanent austerity measures. The Eurozone structure has perpetuated industrial decline and financial constraints, exacerbating economic challenges for countries within the union.

How has the rise of cloud capital impacted traditional capitalism?

The rise of cloud capital, funded by central bank money, has transformed traditional capitalism by shifting the focus towards data analytics and digital platforms. Companies like Amazon and Uber now control markets through these technologies, altering market dynamics and profit structures. This shift away from traditional profits towards cloud rents and digital platforms signals a departure from conventional capitalism, with implications for economic structures and power dynamics. The influence of cloud capital highlights the evolving nature of capitalism in the digital age, reshaping industries and market competition.

Related videos

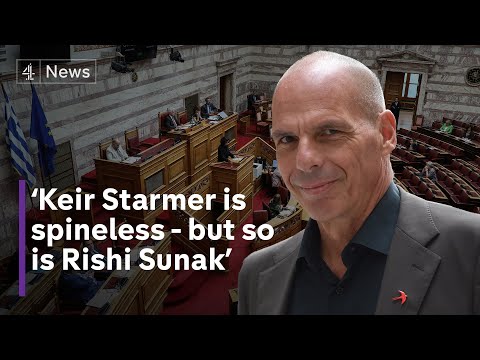

Channel 4 News

Yanis Varoufakis on the death of capitalism, Starmer, and the tyranny of big tech

Times Radio

Capitalism is over and ‘social democracy is finished’ | Yanis Varoufakis

euronews

Capitalism as we know it is over, so what comes next? | My Wildest Prediction with Varoufakis

PoliticsJOE

Yanis Varoufakis explains how big tech is economically dominating your life

The Institute of Art and Ideas

IN FULL Yanis Varoufakis welcomes us to the age of Technofeudalism | Full interview

Summary

00:00

Tech Giants, Cloud Capital, and Global Economy

- Amazon generates 42 billion annually in Europe but pays zero taxes.

- The guest suggests moving towards post-capitalism may lead to greater inequality.

- Capitalism's downfall was not due to labor but to a mutated form of capital called Cloud Capital.

- Cloud Capital allows tech giants like Jeff Bezos to extract huge profits, resembling feudalism.

- The emergence of Chinese tech giants challenges American dominance, merging tech and banking power.

- The fusion of big tech and big finance in China creates powerful apps like WeChat.

- The US abandoned the gold standard in 1971, leading to a centrally planned global economy.

- Between 1944 and 1971, fixed exchange rates and interest rates created a stable economic environment.

- The US maintained a trade surplus post-WWII, ensuring the recycling of dollars globally.

- A trade deficit in the late 1960s led to concerns about the dollar's value and gold redemption.

16:28

Rise of American Hegemony and Financialization

- The fixed exchange rate regime broke down due to an increasing quantity of dollars, leading to the rise of American hegemony.

- Americans utilized their trade deficit to enhance their hegemonic power by providing demand for exports from various countries.

- This situation led to the emergence of neoliberalism and financialization, culminating in the 2008 crash.

- Between 2002 and 2007, financialization saw a significant increase, with global GDP transactions rising from $50 trillion to $75 trillion, and global money market bets escalating from $70 trillion to $750 trillion.

- The constraints on bankers from the New Deal era were removed, leading to excessive money creation and financialization.

- After the 2008 crisis, central banks printed $35 trillion to bail out bankers, resulting in inflated asset prices but minimal investment.

- The rise of cloud capital, funded by central bank money, has transformed industries like car manufacturing, favoring companies like Tesla over traditional manufacturers like Volkswagen.

- The alignment between national and family capital against cloud capital and finance firms like Black Rock has been a significant factor in recent political shifts.

- The dominance of the dollar benefits American and Chinese capitalists but harms the American working class, abandoned by the Democratic party.

- The division lies within countries between the capitalist class and the proletariat, rather than between nations, highlighting conflicting interests within societies.

33:00

"Eurozone's Impact: Austerity, Decline, and Shifts"

- The Euro project primarily benefits German exporters, leading to permanent decline and austerity for countries like Italy and France.

- Membership in the Eurozone results in internal devaluation and reduced purchasing power for citizens.

- Upon entering the Eurozone, countries like Greece had to destroy their printing presses, limiting their financial autonomy.

- Nominal wages in Greece have decreased significantly since 2007, contributing to public anger and political shifts.

- The Eurozone's structure traps countries like Italy and Greece, leading to mass emigration and economic struggles.

- The Eurozone perpetuates permanent austerity and industrial decline for major countries like France, Italy, and Greece.

- The pandemic allowed governments to accumulate significant debt, benefiting the elite while burdening the working class.

- Central bank money and cloud rents are replacing traditional profits in the economy, leading to a shift away from capitalism.

- Companies like Amazon and Uber control markets through data analytics and digital platforms, altering traditional market dynamics.

- Europe's relevance is diminishing globally, with a focus shifting towards China and other emerging powers, signaling potential conflict and geopolitical shifts.

48:58

Europe's Political Paralysis and Big Tech Dominance

- Representation at negotiations for Ukraine includes Zelensky, Putin, Biden, Modi, and Xi, with Europe lacking a significant representative due to Merkel's absence and the perceived influence of Poland, Lithuania, Estonia, Finland, and Sweden.

- Europe's political paralysis is attributed to a lack of clout capital, demographic challenges, and reliance on major tech companies like Google, Uber, Facebook, Apple, and Amazon, with Amazon alone making significant profits in Europe without paying taxes.

- Small countries' representatives like Kallas from Estonia leading European discourse on Ukraine-Russia conflict raises concerns about Europe's standing and the dominance of NATO over the EU.

- The disconnect between foreign policy, defense preferences, and the electorate is highlighted, with a focus on the potential end game in the war in Ukraine and the implications for individual autonomy in a cloud capital-dominated world.

- The impact of big tech on economies and individual autonomy is discussed, with a shift towards a surveillance society where personal online presence influences job prospects, leading to a reevaluation of the concept of the liberal individual in a cloud capital era.