Lecture 9: The Phillips Curve and Inflation

MIT OpenCourseWare・32 minutes read

The Phillips curve, initially discovered by AW Phillips, illustrates the negative relationship between unemployment and inflation, becoming a central concept in macroeconomics advised by economists like Paul Samuelson and Robert Solow. Over time, changes in factors like markup and worker bargaining power affect unemployment levels, highlighting the importance of estimating the natural rate of unemployment for macroeconomists and central bankers.

Insights

- The Phillips curve, named after AW Phillips, showcases a historical negative correlation between unemployment and inflation, forming a foundational concept in macroeconomics.

- Changes in factors like labor market conditions and inflation expectations impact the relationship between unemployment and inflation, with the natural rate of unemployment serving as a critical determinant affecting inflation levels and policy decisions.

Get key ideas from YouTube videos. It’s free

Recent questions

What is the Phillips curve?

The Phillips curve shows the relationship between unemployment and inflation.

Related videos

Summary

00:00

"Phillips Curve: Unemployment, Inflation, Macroeconomics"

- The Phillips curve and inflation are discussed by Ricardo Caballero, emphasizing its importance in macroeconomics.

- The Phillips curve was initially an empirical relationship discovered by AW Phillips in the 1950s, showing a negative correlation between unemployment and inflation.

- Paul Samuelson and Robert Solow named this relationship the Phillips curve in honor of AW Phillips, and it has become a central concept in macroeconomics.

- The relationship between unemployment and inflation is illustrated through historical data from the US, showing a negative correlation.

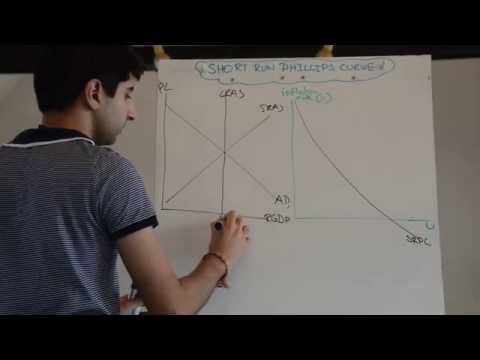

- The theory behind the Phillips curve is developed using wage setting and price setting equations, leading to a downward-sloping relationship between inflation and unemployment.

- The relationship between inflation and unemployment is explained through wage pressures and price adjustments based on labor market conditions.

- By taking the logs of the equations, a relationship between inflation and unemployment is derived, showing how higher unemployment leads to lower inflation.

- The Phillips curve can be simplified to a downward-sloping line when expected inflation is considered constant, reflecting the trade-off between unemployment and inflation.

- The theory behind the Phillips curve aligns with historical data, showing a negative relationship between unemployment and inflation in the US during the 1960s.

- Economists like Bob Solow and Paul Samuelson used the Phillips curve to advise the US government on managing unemployment and inflation, recognizing the negative trade-off between the two factors.

16:22

"Phillips Curve: Unemployment, Inflation, Expectations, Reanchoring"

- Initially, lowering unemployment led to minimal inflation due to a flat curve, allowing significant unemployment reduction without substantial inflation.

- Over time, the deal deteriorated as further unemployment reduction resulted in significant inflation increase.

- People initially accepted this model assuming low inflation until they realized it was being exploited, leading to changed expectations.

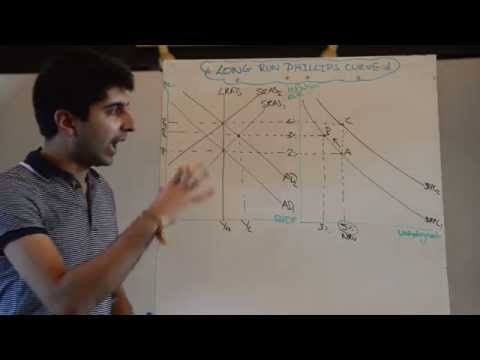

- The Phillips curve model held up well during this time, becoming steeper with increased efforts to lower unemployment.

- In the 1970s to 1995, the data showed no negative relationship, with inflation scattered unpredictably.

- External factors like oil price shocks and wars in the Middle East caused significant inflation spikes, disrupting the relationship.

- Inflation expectations became unanchored, deviating from the constant 2% target, causing concern for central banks globally.

- Expected inflation shifted to a weighted average of a long-term target and recent inflation, impacting future inflation predictions.

- Reanchoring inflation expectations in the mid-90s led to a return to a stable Phillips curve relationship, easing concerns for central banks.

- Connecting the Phillips curve to the natural rate of unemployment highlighted how changes in factors like markup and worker bargaining power affect unemployment levels.

31:45

"Natural Unemployment Rate and Inflation Dynamics"

- M plus z can be replaced by alpha times un in the Phillips curve equation.

- The Phillips curve equation can be rewritten as inflation equals expected inflation minus alpha times the gap between unemployment rate and natural rate.

- Unemployment below the natural rate leads to upward pressure on inflation.

- Estimating the natural rate of unemployment is challenging but crucial for macroeconomists and central bankers.

- Unemployment being higher than the natural rate post-financial crisis led to low inflation.

- The US faced low unemployment and stagnant inflation before COVID, indicating a declining natural rate of unemployment.

- A negative gap between unemployment and the natural rate currently drives high inflation.

- Inflationary pressure stems from factors like supply chain issues and low unemployment.

- Expected inflation plays a critical role in determining the need for a recession to control inflation.

- In the US, excess inflation is primarily driven by high aggregate demand rather than supply-side issues.

47:05

Post-pandemic policies to boost labor force participation

- Increasing labor force participation rate is crucial, with policies like reducing unemployment benefits and income supplements post-pandemic to incentivize return to work, considering factors like retirement, health issues, and immigration declines during COVID impacting labor force numbers.