Y2 13) Perfect Competition

EconplusDal・13 minutes read

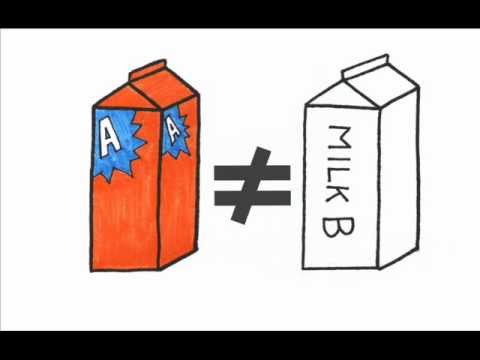

Perfect competition is a theoretical market structure with characteristics like infinite buyers and sellers, homogeneous goods, and firms being price takers. Firms must take the market price, can't set their prices, and aim to maximize profit by producing where marginal cost equals marginal revenue.

Insights

- Firms in perfect competition are price takers, unable to set prices themselves, and must accept the market price to maintain demand and revenue.

- Perfectly competitive markets exhibit no barriers to entry or exit, ensuring free competition and allowing for the efficient allocation of resources based on supply and demand.

Get key ideas from YouTube videos. It’s free

Recent questions

What is perfect competition?

A: Perfect competition is a theoretical market structure used as a benchmark to assess real-world market efficiency. It involves infinite buyers and sellers, homogeneous goods, and firms being price takers.

How do firms in perfect competition set prices?

Firms in perfect competition cannot set their prices and must take the market price to avoid losing demand or revenue.

Are there barriers to entry in perfect competition?

In a perfectly competitive market, there are no barriers to entry or exit, allowing new firms to enter easily and existing firms to leave without restrictions.

How do firms in perfect competition maximize profits?

Firms in perfect competition aim to maximize profits by producing where marginal cost equals marginal revenue, ensuring efficiency in resource allocation.

What happens to profits in the long run in perfect competition?

In the long run, normal profit is the equilibrium point in perfect competition, with no tendency for the market to change. Supernormal profit attracts new firms, leading to price decreases, while subnormal profit prompts firms to exit, causing prices to rise until normal profit is achieved.

Related videos

Summary

00:00

"Perfect Competition: Benchmark for Market Efficiency"

- Perfect competition is a theoretical market structure used as a benchmark to assess real-world market efficiency.

- Characteristics of a perfectly competitive market include infinite buyers and sellers, homogeneous goods, and firms being price takers.

- Firms in perfect competition cannot set their prices and must take the market price to avoid losing demand or revenue.

- There are no barriers to entry or exit in a perfectly competitive market.

- Perfect information of market conditions allows consumers and producers to make informed decisions.

- Firms in perfect competition aim to maximize profits by producing where marginal cost equals marginal revenue.

- In the long run, normal profit is the equilibrium point in perfect competition, with no tendency for the market to change.

- Supernormal profit in perfect competition attracts new firms, leading to a decrease in prices until only normal profit remains.

- Subnormal profit in perfect competition prompts firms to exit the market, causing prices to rise until normal profit is achieved.