Salvage Value (Scrap Value) - Meaning, Calculation with Depreciation Example

WallStreetMojo・7 minutes read

Salvage value is a critical component of depreciation calculations, representing the worth of an asset after its useful life and can lead to fraudulent practices if manipulated. Calculating salvage value involves deducting it from the total cost of the asset before charging depreciation, with the formula including the original cost, depreciation rate, and asset lifespan.

Insights

- Salvage value is a critical component in calculating depreciation, representing the residual worth of an asset post its useful life, which can be manipulated to impact profits and lead to fraudulent practices.

- The formula for determining salvage value factors in the original asset cost, depreciation rate, and expected lifespan, distinguishing it from scrap value in cost accounting related to selling raw materials as scrap post-manufacturing.

Get key ideas from YouTube videos. It’s free

Recent questions

What is salvage value in depreciation calculations?

Salvage value is the worth of an asset after its useful life, deducted from the total cost before depreciation is charged.

How is salvage value calculated for assets?

Salvage value is calculated by deducting it from the total cost of the asset, then applying depreciation on the remaining amount.

What can happen if salvage value is manipulated?

Manipulating salvage value can lead to fraudulent practices, reducing depreciation and inflating profits.

What factors are involved in the formula for salvage value?

The formula includes the original cost of the asset, depreciation rate, and the number of years the asset will last.

In cost accounting, what does scrap value refer to?

In cost accounting, scrap value refers to the raw material of a product sold off as scrap, distinct from asset obsolescence.

Related videos

Alanis Business Academy

How to Calculate Depreciation

jjasso5

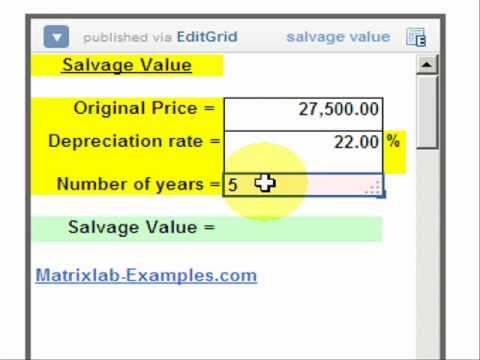

Salvage Value Calculation

B Newhart

4 Steps to Calculate Depreciation using the Straight Line Method

Commerce Wallah by PW

Depreciation - 1 Shot - Everything Covered | Class 11th | Accountancy 🔥

Accounting Stuff

DEPRECIATION BASICS! With Journal Entries

Summary

00:00

Understanding Salvage Value in Depreciation Calculations

- Salvage value is a crucial part of depreciation calculations, deducted from the total cost of an asset before depreciation is charged.

- The salvage value, also known as the scrap value, represents the worth of an asset after its useful life ends, often sold as scrap.

- Calculating salvage value involves deducting it from the total cost of the asset, then charging depreciation on the remaining amount.

- Fraudulent practices can occur if the salvage value is manipulated to reduce depreciation and inflate profits.

- The formula for calculating salvage value includes the original cost of the asset, depreciation rate, and the number of years the asset will last.

- In cost accounting, the scrap value refers to the raw material of a product that a manufacturer sells off as scrap, distinct from the obsolescence of assets.