Kalecki's theory of distribution | Malayalam | Deepesh Manoharan | LIFE ECONOMICS

LIFE ECONOMICS・5 minutes read

The Galaxy Theory of Distribution suggests that firms can expand production under constant costs until reaching capacity to enhance market share, while monopoly power, measured by the Lerner's index, enables firms to set prices above costs for additional profits. Additionally, there is an inverse relationship between price elasticity and monopoly power, with lower elasticity allowing for increased pricing and total income, as outlined by the provided equations.

Insights

- The Galaxy Theory of Distribution suggests that firms operate under conditions of constant costs and excess capacity, enabling them to expand production to capture more market share until they reach their limits. This framework indicates that businesses can strategically increase output without immediate cost concerns, impacting competitive dynamics in the market.

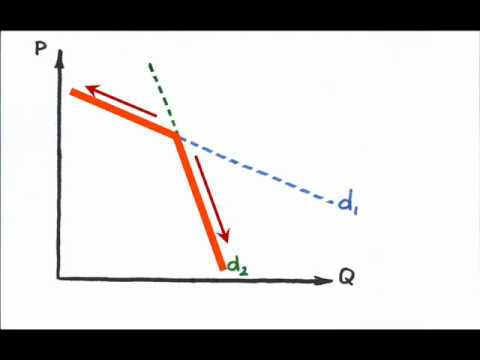

- Monopoly power, measured by Lerner's index, reveals that firms with greater monopoly power can set prices significantly above their production costs, leading to supernormal profits. Additionally, the inverse relationship between price elasticity and monopoly power indicates that as consumers become less sensitive to price changes, firms can raise prices without losing sales, thereby influencing their overall revenue.

Get key ideas from YouTube videos. It’s free

Recent questions

What is monopoly power in economics?

Monopoly power refers to the ability of a firm to set prices above the competitive level, allowing it to earn supernormal profits. This power is often quantified using the Lerner's index, which measures the difference between the price a firm charges and its marginal cost, relative to the price itself. A higher Lerner's index indicates greater monopoly power, enabling firms to exert control over market prices and restrict competition. In essence, monopoly power arises when a single firm dominates a market, leading to reduced consumer choice and potentially higher prices.

How do firms increase market share?

Firms can increase market share by expanding production to meet consumer demand, often leveraging excess market capacity. This strategy involves adjusting output levels to capture a larger portion of the market, which can be particularly effective in industries where marginal and average costs remain constant. By producing more, firms can attract customers from competitors, enhance their visibility in the market, and ultimately achieve economies of scale. Additionally, firms may employ marketing strategies, improve product quality, or innovate to differentiate themselves, further solidifying their market position.

What is price elasticity of demand?

Price elasticity of demand measures how sensitive the quantity demanded of a good is to a change in its price. It is calculated as the percentage change in quantity demanded divided by the percentage change in price. A high price elasticity indicates that consumers will significantly reduce their demand if prices rise, while a low elasticity suggests that demand remains relatively stable despite price changes. Understanding price elasticity is crucial for firms, especially those with monopoly power, as it influences pricing strategies and potential revenue outcomes. As elasticity decreases, firms can raise prices without losing many customers, thereby increasing total income.

What is the Lerner's index?

The Lerner's index is a measure used to quantify a firm's monopoly power in a market. It is calculated using the formula (P - MC) / P, where P represents the price charged by the firm and MC is the marginal cost of production. The index ranges from 0 to 1, with higher values indicating greater monopoly power. A firm with a Lerner's index close to 1 can charge significantly above its marginal cost, allowing it to earn supernormal profits. This index is essential for understanding how much control a firm has over its pricing and the extent to which it can influence market dynamics.

What are supernormal profits?

Supernormal profits, also known as economic profits, occur when a firm's total revenue exceeds its total costs, including both explicit and implicit costs. These profits are above the normal profit level, which is the minimum return necessary to keep resources in their current use. In markets with monopoly power, firms can achieve supernormal profits by setting prices higher than marginal costs, as indicated by the Lerner's index. This ability to earn excess profits can lead to market distortions, as it may discourage competition and innovation, ultimately impacting consumer welfare and market efficiency.

Related videos

Summary

00:00

Galaxy Theory and Monopoly Power Dynamics

- The Galaxy Theory of Distribution assumes constant marginal and average costs, excess market capacity, and that firms can increase production to gain market share until capacity is reached.

- Monopoly power is quantified using the Lerner's index, represented by the equation (P - MC) / P, indicating that higher monopoly power allows firms to charge above production costs for supernormal profits.

- The relationship between price elasticity and monopoly power is inverse; as elasticity decreases, firms can charge higher prices, affecting total income, which is calculated using the equation σ(P - AC) * x = σ(Pμ) * x.