Journal entries | Rules of Debit and Credit | All Basics covered | Part 1 | Accounts | Class 11

Rajat Arora・23 minutes read

Understanding General Entries is crucial in commerce and mastering concepts can be achieved by watching a few videos. Transactions progress from vouchers to General Entries, then to ledger, trial balance, and financial statements, with accounts categorized into real, personal, and nominal, each with specific rules for debits and credits.

Insights

- Understanding General Entries is vital for success in commerce, involving the systematic recording of financial transactions in a business, progressing from vouchers to ledger and financial statements.

- Learning journal entries through traditional and modern approaches, categorizing accounts into real, personal, and nominal with specific rules for debits and credits, is crucial for mastering the concept effectively.

Get key ideas from YouTube videos. It’s free

Recent questions

What is the importance of understanding General Entries in commerce?

Understanding General Entries is crucial in commerce as it involves systematically recording financial transactions in a business. Mastery of this concept is essential for success in the field.

How can one master the concept of General Entries?

Watching five to eight videos on General Entries can help in mastering the concept effectively. This visual learning approach can aid in understanding the systematic recording of financial transactions.

What are the key components of a journal entry format?

The format of a journal entry includes particulars, date, ledger folio, debit amount, and credit amount. These components are essential for accurately recording financial transactions in a business.

What are the different categories of accounts in General Entries?

Accounts are categorized into real, personal, and nominal accounts, each with specific rules for debits and credits. Real accounts involve assets, personal accounts relate to individuals or entities, and nominal accounts cover expenses and income.

How are transactions involving machinery or furniture recorded in General Entries?

Transactions like purchasing machinery for cash or selling furniture for cash involve specific rules in General Entries. For example, when machinery is purchased for cash, the machinery account is debited, and cash account is credited. Similarly, when furniture is sold for cash, the furniture account is debited, and cash account is credited.

Related videos

Manisha commerce classes

triple column cash book in hindi

Rajat Arora

Journal Entries | Accounting | Rules of Debit and Credit.

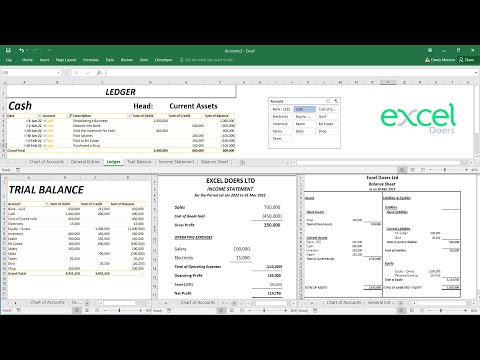

EXCEL DOERS

How to automate Accounting Ledger, Trial Balance, Income Statement, Balance Sheet in Excel | English

Rajat Arora

Introduction to Accounting | Meaning and Objectives of Accounting | Class 11 | Chapter 1

THE GAURAV JAIN

Cash Book Class 11 ONE SHOT | Accounts GAURAV JAIN

Summary

00:00

Mastering General Entries in Commerce Transactions

- General Entries are crucial in commerce and understanding them is essential for success in the field.

- Watching five to eight videos on General Entries can help in mastering the concept.

- General Entries involve systematic recording of various financial transactions in a business.

- Transactions lead to the creation of vouchers specifying debit and credit accounts.

- Debit refers to the left side of an account, while credit is on the right side.

- Transactions progress from vouchers to General Entries, then to ledger, trial balance, and financial statements.

- The format of a journal includes particulars, date, ledger folio, debit amount, and credit amount.

- Two approaches to learning journal entries are traditional and modern, both equally effective.

- Accounts are categorized into real, personal, and nominal, each with specific rules for debits and credits.

- Real accounts involve assets, personal accounts relate to individuals or entities, and nominal accounts cover expenses and income.

16:56

Basic Machinery Transactions and Accounting Rules

- Machinery purchased for cash involves a basic transaction where the machinery account is debited and cash account is credited.

- When machinery is bought but money is not given, the rule of debit is applied, debiting the machinery account.

- If the machine is bought but money is not given, it is considered a loan, and the credit rule is applied.

- When furniture is sold for cash, the furniture account is debited and cash account is credited.

- If furniture is sold but money is not received, the receiver's account is debited, following the debit rule.

- When cash is paid to someone like Ram, the receiver's account (Ram) is debited, and cash account is credited.

- In nominal transactions, all expenses and losses are debited, while all incomes and gains are credited.

- For example, when salary is paid, the salary account is debited as an expense, and cash account is credited.