How to Find Multibagger Stocks? | Best Shares for Investment

Pushkar Raj Thakur: Stock Market Educator 📈・24 minutes read

To identify potential multi-bagger stocks, focus on small-cap companies with growth potential by considering factors like low prices, P ratio, and market cap. Check for companies with low debt, increasing revenue, and stable assets while monitoring cash flow, charts, and differentiating between market and limit orders when buying shares.

Insights

- Focus on identifying small-cap companies with growth potential and low-priced stocks that could increase in value, considering factors like market cap, P ratio, revenue growth, and debt-to-equity ratios to narrow down potential multi-bagger stocks.

- Utilize strategies such as analyzing price action, monitoring cash flow, and implementing stop loss tactics like the green line to manage risk and maximize potential upside when investing in shares, emphasizing the importance of liquidity and understanding order types like market and limit orders for informed decision-making.

Get key ideas from YouTube videos. It’s free

Recent questions

How can I identify potential multi-bagger stocks?

Focus on small-cap companies with growth potential, low prices, and strong financial indicators like low debt-to-equity ratios and increasing revenue and profit. Apply filters like market cap and analyze charts for price action.

What factors should I consider when buying stocks?

Look at the date of stocks, P ratio, comparison with other companies, debt-to-equity ratios, revenue and profit growth, stable assets and liabilities, cash flow, and potential upside. Differentiate between market orders and limit orders, considering liquidity for larger companies.

What is the significance of a stop loss strategy?

A stop loss strategy, using a green line as a reference point, helps manage risk by automatically selling a stock if it reaches a certain price. This strategy is crucial for beginners to protect their investments and limit potential losses.

What is a hammer candlestick pattern in stock trading?

A hammer candlestick pattern is a bullish reversal pattern that indicates a potential market turnaround. It is characterized by a small body with a long lower shadow, suggesting buying interest and a possible upward trend when the high price of the candlestick is broken.

How do I differentiate between market orders and limit orders when buying stocks?

Market orders are executed at the current market price, while limit orders allow you to set a specific price at which you want to buy or sell a stock. Market orders guarantee execution but not price, while limit orders provide price control but not execution certainty.

Related videos

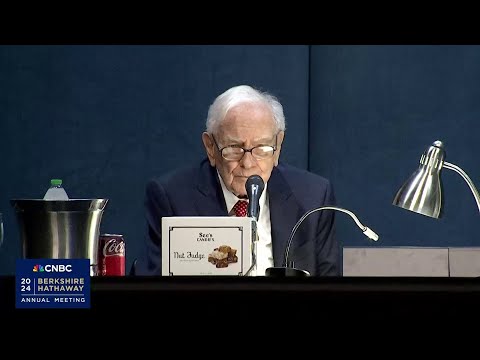

CNBC Television

Warren Buffett breaks down how he would invest if he had to start again with $1 million

The Inner Circle Trader

ICT Mentorship Core Content - Month 02 Growing Small Accounts

TED-Ed

How do investors choose stocks? - Richard Coffin

जोश Talks

STOCK MARKET में ये काम कभी मत करना | Ankit Mittal | Share Market | option trading |Josh Talks Hindi

warikoo

MUTUAL FUND Investing Strategies for BEST Returns in 2024! | Ankur Warikoo Hindi

Summary

00:00

Identifying Multi-Bagger Stocks: Key Factors to Consider

- To identify multi-bagger stocks, focus on small-cap companies with potential for future growth.

- Look for stocks currently at low prices that have the potential to increase in value.

- Consider factors like the date of stocks, P ratio, and comparison with other companies.

- Apply filters like a market cap of Rs 4000 crore to narrow down potential stocks.

- Check for companies with low debt-to-equity ratios and low P ratios.

- Focus on companies with increasing revenue and profit, stable assets, and liabilities.

- Monitor cash flow and potential upside for selected companies.

- Analyze charts for price action and consolidation zones.

- Differentiate between market orders and limit orders when buying stocks.

- Consider liquidity when buying shares, especially for larger companies like IGL.

12:39

"Stock Trading Strategies for Beginners"

- The deal is struck at 35, while the price is at 57.1, with the buyer ready to buy at the same price.

- The buyer receives 250 shares after the limit imposed is executed.

- A stop loss strategy is discussed, using a green line as a reference point.

- The green line acts as a stop loss at around 404, with the stock automatically moving up as it increases.

- The importance of the green line for beginners is emphasized, especially in relation to the stock's performance.

- A candlestick pattern known as a hammer is mentioned, indicating a potential market reversal.

- The high price of the candlestick is highlighted at 395, suggesting a buy when it breaks.

- The process of choosing a multibagger stock is detailed, aiming for significant growth.

- Practical steps for buying shares, including quantity and price considerations, are outlined for a specific stock.