How Science is Taking the Luck out of Gambling - with Adam Kucharski

The Royal Institution・62 minutes read

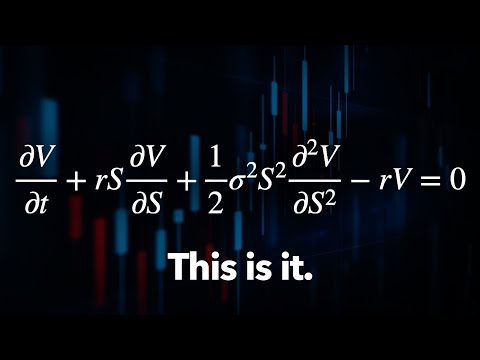

Researchers and mathematicians have utilized mathematical models and strategies in various forms of gambling, from lotteries to card games, to gain an advantage and maximize profit. The use of statistics, simulations, and intelligent algorithms in predicting outcomes has revolutionized the gambling industry, emphasizing the importance of strategic decision-making and data analysis in achieving success.

Insights

- Mathematicians and scientists have historically used mathematical models to gain an edge in games of chance, dating back to the 16th century with Jolo Cardano introducing the concept of quantifying luck and random events.

- The development of hypothesis testing by Carl Pearson led to successful strategies in various fields like clinical trials, particle physics experiments, and even identifying biases in gambling tables, impacting industries beyond just gambling.

- The Monte Carlo method, devised by Stanislav Ulam, has found extensive applications in fields like disease outbreaks, sports betting, and poker, showcasing its versatility in solving complex problems through simulations.

Get key ideas from YouTube videos. It’s free

Recent questions

What is the Monte Carlo method?

A simulation-based approach to solve complex problems.

Related videos

Summary

00:00

"Mathematical Models in Infectious Diseases and Gambling"

- The speaker is a researcher specializing in mathematical models of infectious diseases at the London School of Hygiene & Tropical Medicine.

- Science and gambling have a long intertwined history, with mathematicians and scientists using techniques to gain an edge in games of chance.

- The concept of quantifying luck and random events is relatively recent, dating back to the 16th century with Italian mathematician Jolo Cardano.

- The UK National Lottery requires picking six numbers from a set of 59, resulting in over 45 million possible combinations.

- A Syndicate in the 1990s bought up all combinations for the Irish National Lottery, costing less than a million pounds, and won a profit of 300,000 pounds.

- Mohan Srivastava discovered a pattern in scratch cards that identified winning cards without scratching them, but chose not to exploit it due to the rarity of winning cards.

- French mathematician Henri Poincaré classified ignorance levels in predicting outcomes, with the third level being when rules are unknown or too complex to decipher.

- Carl Pearson analyzed roulette spins in Monte Carlo, finding deviations from expected values that suggested bias in the tables.

- Pearson's analysis of pairs of numbers in roulette spins indicated a lack of expected color strings, leading him to conclude the tables were biased.

- Pearson's findings led him to suggest closing down the casinos in Monte Carlo due to perceived corruption, which was later attributed to errors in data reporting.

13:09

"Strategic Betting: From Hypothesis Testing to Finance"

- The concept of hypothesis testing was introduced by Pearson, used in various fields like clinical trials and particle physics experiments.

- Medical students in the late 1940s discovered biases in gambling tables, leading to successful strategies and financial gains.

- Physics students in the 60s and 70s realized the importance of understanding the physics behind roulette tables for predicting outcomes.

- Hidden computers were developed to aid in real-time calculations for predicting roulette outcomes, despite challenges like weather changes affecting predictions.

- Bill Benter, a successful gambler, utilized card counting in Blackjack, taking advantage of the predictability of shuffled decks.

- The use of multiple decks in casinos made card counting more challenging, but the dovetail shuffle technique inadvertently provided gamblers with an advantage.

- John Kelly's formula for optimal betting fraction based on odds and probabilities helped gamblers maximize long-term growth while limiting losses.

- Simulations showed that betting a quarter of one's income, following Kelly's strategy, led to steady growth without going bankrupt, unlike riskier betting strategies.

- Different betting percentages, like 80% or 10%, resulted in varying outcomes in simulations, highlighting the importance of strategic money management in gambling.

- The concept of utility in money management, as seen in Kelly's formula and betting strategies, is crucial not only in gambling but also in finance and the insurance industry.

25:21

"Gambling Syndicates Use Data for Predictions"

- Card counting can be challenging due to the difficulty of getting away with it, leading successful individuals like Bill Benser to be banned from casinos worldwide.

- Happy Valley Race Course in Hong Kong is a popular spot for gambling, with approximately $150 million wagered on a typical race day.

- Francis Galton, a Victorian scientist and cousin of Charles Darwin, introduced the concept of regression to mediocrity, which influenced the understanding of inheritance and characteristics convergence over generations.

- Galton's regression theory in statistics, based on the inheritance of characteristics, laid the foundation for analyzing factors influencing an object or system's performance.

- Bill Benter discovered a research paper by Ruth Bolton and Rand Chapman in the 1980s, outlining a method for converting data into performance measures for predicting horse race outcomes.

- Syndicates in Hong Kong found that certain factors, like the number of races a horse had run, were significant in predicting performance, emphasizing the importance of data analysis in making accurate predictions.

- Correlation in statistics doesn't always imply causation, as seen in examples like wine spending in Cambridge colleges and chocolate consumption in Nobel Prize-winning countries.

- Syndicates focus on predicting race outcomes rather than understanding the reasons behind them, embracing their ignorance to prioritize effective prediction methods.

- Variability in performance among multiple horses can lead to unexpected results, with the most variable horse having a higher chance of winning in certain scenarios.

- Game theory, originating from poker in the 1920s with John Von Neumann, explores strategic decision-making in games like poker, emphasizing the balance between maximizing gains and minimizing opponents' gains.

37:47

"Randomness, Simulation, and Regret in Poker"

- Picking randomly in games like rock-paper-scissors can prevent opponents from predicting your moves and gaining an advantage.

- Stanislav Ulam, a mathematician, developed the Monte Carlo method as a simulation-based approach to solve complex problems that couldn't be easily solved with equations.

- The Monte Carlo method was used in the US nuclear program for neutron collisions, proving its effectiveness in random processes.

- The method is widely used in various fields like disease outbreaks, sports betting, and poker, where simulations help understand complex interactions and strategies.

- Alan Turing suggested building intelligent machines by allowing them to learn, as seen in poker teams creating algorithms that learn through simulations.

- Poker algorithms use regret minimization to improve decisions, analyzing past choices to enhance future strategies.

- Studies show that the ability to feel regret is crucial in learning games of chance, as seen in neurological research on decision-making.

- Poker algorithms have reached a level where they can play perfectly against each other, ensuring they won't lose money in the long run.

- Despite the success of these algorithms, there's a risk in assuming opponents are perfect, potentially missing opportunities to exploit their flaws.

- Human memory limitations are highlighted in strategies like chunking and bucketing, used in card counting and memory competitions to enhance recall and processing of information.

50:48

Algorithmic Trading and Market Manipulation Court Cases

- In Norway, two traders taught an algorithm to make small trades to manipulate its price, followed by a large trade to profit, leading to court charges of market manipulation.

- The traders were initially charged but gained a Robin Hood reputation, and upon appeal, the court ruled that trading against a flawed algorithm differed from trading against a human.

- A US stock broker's algorithm, lacking a counter on the eighth server, caused high-speed trades, resulting in a $450 million loss in 45 minutes.

- In a legal case, economists and mathematicians debated whether poker was a game of skill or chance, with a US court ruling it as a game of skill.

- The definition of gambling varies, with federal law defining it as predominantly due to chance, while New York state law defines it as having a material element of chance, impacting the classification of poker and other games.