EACC506 - U01L10 - Elements of financial statements

videolpuonline 2・13 minutes read

The lecture covers the essential elements of financial statements, including the balance sheet, profit and loss account, Cash Flow Statement, and statement of changes in equity. These statements provide crucial insights into a company's financial position, performance, and cash flow activities over a specific period.

Insights

- The balance sheet provides a snapshot of a company's financial position at a specific date, showcasing assets, liabilities, and shareholder equity in a solvency order, answering questions about asset value, financial obligations, and shareholder stake.

- The Cash Flow Statement summarizes cash inflows and outflows across operating, investing, and financing activities, explaining the movement of money in the company, while the statement of changes in equity reconciles opening and closing balances of shareholders' equity, detailing changes in reserves, surpluses, retained earnings, and share capital over a specific period.

Get key ideas from YouTube videos. It’s free

Recent questions

What does a balance sheet show?

A balance sheet displays a company's assets, liabilities, and shareholder equity at a specific date. It provides a snapshot of the financial position of the company, showcasing what it owns (assets), what it owes (liabilities), and the amount left for shareholders (equity).

What is the purpose of a profit and loss statement?

The profit and loss statement, also known as the income statement, illustrates a company's financial performance over a specific period. It shows the revenue generated, expenses incurred, and ultimately the profit or loss made by the company during that time frame.

How does a Cash Flow Statement differ from a profit and loss statement?

While a profit and loss statement focuses on revenue, expenses, and overall financial performance, a Cash Flow Statement summarizes the movement of cash in and out of the company during a specific period. It provides insights into how cash is being generated and used by the business.

What are the main activities covered in a Cash Flow Statement?

A Cash Flow Statement typically includes three main activities: operating, investing, and financing. Operating activities involve cash flows from core business operations, investing activities relate to cash flows from buying and selling fixed assets, and financing activities cover cash flows related to financing the company's operations.

Why do companies prepare a statement of changes in equity?

The statement of changes in equity reconciles the opening and closing balances of shareholders' equity, detailing movements in reserves, surpluses, retained earnings, and share capital over a specific accounting period. While not mandatory under some accounting standards, like IFRS, many companies still prepare this statement separately to provide a comprehensive view of changes in equity.

Related videos

ICAI CA Tube

Intermediate Paper 1:AA | Topic: Ch11: Financial Statements of Companies | Session 1 | 12 June, 2024

CA Parag Gupta 2.0

Ch 11 Unit 1 Preparation of Financial Statements - 1 | CA Inter Advanced Accounting | CA Parag Gupta

LPU Online Distance Education

EACC506 - U01L04 - Accounting Terminology

EXCEL DOERS

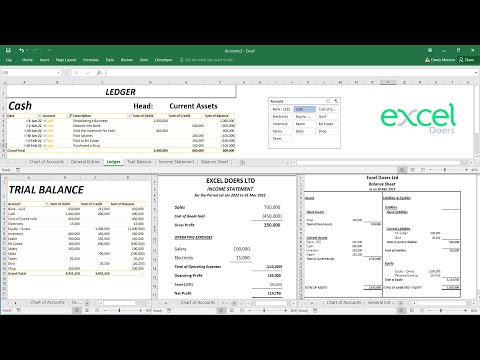

How to automate Accounting Ledger, Trial Balance, Income Statement, Balance Sheet in Excel | English

Rajat Arora

Introduction to Accounting | Meaning and Objectives of Accounting | Class 11 | Chapter 1

Summary

00:00

Understanding Financial Statements: Key Components Explained

- Lecture focuses on elements of financial statements

- Learning outcome is to identify and explain types of financial statements and their components

- Four compulsory financial statements: balance sheet, profit and loss account, Cash Flow Statement, and statement of changes in equity

- Balance sheet is a snapshot of company's finances at a specific date

- Balance sheet shows assets, liabilities, and shareholder equity

- Assets side includes non-current and current assets, while liabilities side includes equity, non-current liabilities, and current liabilities

- Balance sheet prepared in solvency order, showing long-term assets and liabilities first

- Questions answered by balance sheet include asset value, financial obligations, and shareholder stake

- Profit and loss statement shows revenue, expenses, and financial performance over a period

- Elements of profit and loss statement include sales, cost of goods sold, gross profit, operating expenses, and profit before tax

- Cash Flow Statement summarizes cash inflows and outflows for a period

- Cash Flow Statement explains movement of money in the company

15:50

Financial Statements Overview: Cash Flow and Equity

- Cash flow statement format includes three main activities: operating, investing, and financing. Operating activities involve core business transactions, investing activities relate to fixed asset transactions like purchases and sales, and financing activities cover financing-related transactions such as issuing share capital or paying dividends.

- The statement of changes in equity reconciles the opening and closing balances of shareholders' equity, detailing movements in reserves, surpluses, retained earnings, and share capital over a specific accounting period. While not mandatory under some accounting standards, like IFRS, many companies still prepare this statement separately.