Article 1387-1389

Ginelle Libanan・2 minutes read

Article 1387 of the Civil Code presumes fraudulent intent in donations or sales made to evade creditors, with specific examples illustrating how these transactions can be challenged, while Article 1388 holds buyers accountable for compensating creditors if they knowingly purchase such property. Furthermore, the articles outline liability among multiple buyers and set a four-year limit for claiming rescission of contracts, with exceptions for those under guardianship or absentees.

Insights

- Article 1387 of the Civil Code presumes that donating property while having outstanding debts is an attempt to defraud creditors, as illustrated by JN giving away a $5,000 car while owing $10,000, which raises red flags about his intentions to avoid repaying his debts.

- Under Article 1388, buyers who knowingly purchase property sold to evade debts, like Mary buying John's car despite his debts, are required to compensate his creditors for any losses, emphasizing that both the seller and buyer share responsibility in fraudulent transactions, and liability extends to subsequent buyers if the property changes hands.

Get key ideas from YouTube videos. It’s free

Recent questions

What is a fraudulent transfer?

A fraudulent transfer refers to a transaction where a person transfers property or assets with the intent to evade creditors or avoid paying debts. This can occur when an individual donates or sells property without retaining sufficient assets to cover their existing obligations. For example, if someone who owes a significant amount of money gives away valuable items, it may be presumed that they are attempting to defraud their creditors. Legal frameworks often have specific provisions to address such transfers, allowing creditors to challenge these transactions and seek recovery of their debts.

How can I protect my assets from creditors?

Protecting assets from creditors typically involves legal strategies that comply with the law while safeguarding personal property. One common method is to place assets in a trust, which can provide a layer of protection against creditors. Additionally, individuals may consider restructuring their debts or negotiating settlements to manage their financial obligations more effectively. It's also advisable to consult with a legal professional who specializes in asset protection to explore options such as exemptions under state laws, which can shield certain assets from creditor claims. However, it is crucial to avoid any actions that could be construed as fraudulent transfers, as these can lead to legal repercussions.

What happens if I sell property to avoid debts?

Selling property to avoid debts can lead to serious legal consequences, as such actions are often deemed fraudulent. If a seller has a court judgment against them and sells property, the transaction may be presumed fraudulent, regardless of the sale's terms. Creditors can challenge the sale, and the buyer may be held liable for compensating the creditors if they knowingly participated in the transaction. This means that even if the buyer cannot return the property, they may still be responsible for covering the losses incurred by the creditors, highlighting the importance of conducting transactions transparently and ethically.

Can creditors claim against a buyer of property?

Yes, creditors can claim against a buyer of property if the buyer knowingly acquires assets sold to evade debts. In such cases, the buyer may be required to compensate the creditors for any losses incurred, even if the property cannot be returned. This liability extends to multiple buyers if the property changes hands, as creditors can pursue compensation in the order of acquisition. This legal framework is designed to prevent individuals from circumventing their financial responsibilities through the sale of assets, ensuring that creditors have avenues to recover their debts.

What is the time limit for rescinding a contract?

The time limit for rescinding a contract is generally four years, as established by legal statutes. This period begins when the aggrieved party becomes aware of the grounds for rescission. However, there are exceptions for individuals under guardianship or those who are absent, where the limitation period only starts once their status changes. This means that if a person is unable to act due to legal constraints, they may have additional time to seek rescission of a contract. Understanding these time limits is crucial for individuals looking to challenge contracts that may have been entered into under questionable circumstances.

Related videos

atty. Rosario

Rescissible contracts

Ultimate CA

Sale of Goods Act ( SOGA) Revision CA Foundation Law | Unit 3 | CA Indresh Gandhi

Dr Megh Raj

What is misrepresentation in prospectus? What are its consequences and remedies?

Jack Guttenberg

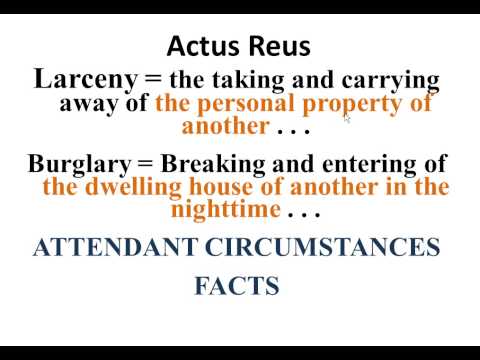

Criminal Law Video Presentation 2 Actus Reus

University of Virginia School of Law

Inside the Classroom: Contracts With Professor George Geis

Summary

00:00

Fraudulent Transfers and Creditor Rights Explained

- Article 1387 of the Civil Code states that if a person donates property without retaining enough to pay off existing debts, it is presumed they did so to defraud creditors. For example, if JN, who owes $10,000, gives away a $5,000 car to Mary without other assets, this act is presumed fraudulent as it appears to be an attempt to avoid debt repayment.

- The second paragraph of Article 1387 indicates that if a seller has a court judgment against them and sells property, the sale is presumed fraudulent, regardless of whether the judgment specifically mentions the property. For instance, if Sarah sells her house to Emily below market value after a judgment is issued against her, the sale can be deemed fraudulent even if the judgment does not mention the house.

- Article 1388 specifies that a buyer who knowingly acquires property sold to evade debts must compensate the creditors for any losses incurred, even if the item cannot be returned. For example, if Mary buys John's car knowing he is in debt, she must compensate his creditors if they cannot recover their money from John.

- The second paragraph of Article 1388 states that if multiple buyers acquire an item sold to avoid debts, they are liable to compensate creditors in the order of acquisition. For instance, if John sells his car to Mary, who then sells it to David, both aware of John's debts, creditors can first seek compensation from Mary, and if she cannot pay, they can pursue David next. Additionally, Article 1389 establishes a four-year limit to claim rescission of a contract, with exceptions for individuals under guardianship or absentees, where the period starts only when their status changes.